The First Home Loan Deposit Scheme, which started on 1 January 2020, will be targeted towards first home buyers earning up to $125,000 annually or $200,000 for couples. The value of homes that can be purchased under the Scheme will be determined on a regional basis, reflecting the different property markets across Australia.

The First Home Loan Deposit Scheme will mean first home buyers won’t need to save for a full 20 per cent deposit, so Australians can get a loan and into the market faster. The Scheme will also help first home buyers save around $10,000 by not having to pay Lenders Mortgage Insurance.

For a property to be eligible it must be a ‘residential property’ – this term has a particular meaning under this Scheme. Eligible residential properties include:

- an existing house, townhouse or apartment

- a house and land package

- land and a separate contract to build a home

- an off-the-plan apartment or townhouse

Specific dates and requirements apply for the different property types, and different timeframes can apply to your Scheme place, depending on the type of home you buy. One of our brokers will make this information available to you.

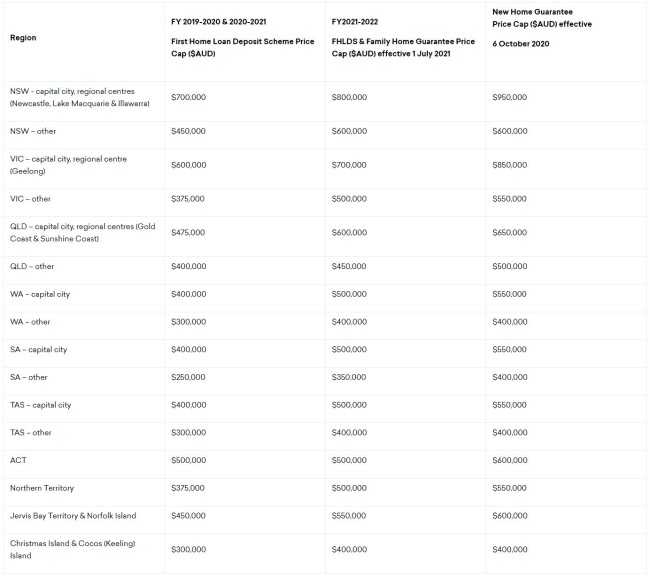

Property price caps vary according to which financial year is applicable to your scheme place, and where your property is located (in a capital city, large regional centre or regional area). The table shown below provides a basic understanding of the caps, but one of our brokers should be consulted for a more accurate understanding.

To be eligible for this Scheme, the contract of sale and (if applicable) eligible building contract may have particular dates when they can be signed by you. There are no exceptions from these required dates.

How Much Do I Need to Save?

You need to have between 5% and 20% of the value of an eligible property saved as a deposit. While the minimum deposit required by this Scheme is 5%, Participating Lenders may require a higher percentage deposit based on your financial circumstances. Speak with your lender to find out whether the deposit you have is made up of genuine savings for the purposes of their lending criteria and this Scheme.

Participating Lenders

Participating lenders are as follows (this list may change). We’ll have more relevant and up-to-date information for you when we have a discussion.

- Australian Military Bank

- Auswide Bank

- Bank Australia

- Bank First

- Bank of Heritage Isle

- Bank of Us

- Bendigo Bank

- Beyond Bank Australia

- Border Bank

- Commonwealth Bank

- Community First Credit Union

- Defence Bank

- Endeavour Mutual Bank

- Firefighters Mutual Bank

- G&C Mutual Bank

- Gateway Bank

- Great Southern Bank

- Health Professionals Bank

- Indigenous Business Australia

- MortgagePort

- MyStateBank

- NAB

- P&N Bank

- People’s Choice

- Police Bank

- QBANK | First Home Buyers

- Queensland Country Bank

- Regional Australia Bank

- Sydney Mutual Bank

- Teachers Mutual Bank

- The Mutual Bank

- UniBank

- WAW

Scheme Qualification

The basic qualification requirements apply to scheme participants:

- applying as an individual or couple (married / de facto)

- being Australian citizen(s) at the time you enter the loan

- being at least 18 years of age

- earning up to $125,000 for individuals or $200,000 for couples

- you must intend to be owner-occupiers of the purchased property

- you must be first home buyers who have not previously owned, or had an interest in, a property in Australia

More Information

More information is available on the Government’s First Home website  . Download a fact sheet from the NHFIC website here

. Download a fact sheet from the NHFIC website here  .

.

Contact us for the current state of available subsidies and grants.